- You may be an excellent Canadian resident

- You’ve been functioning complete-returning to at the very least 3 months

- You have been care about-used in no less than 2 yrs

- You aren’t an earlier broke

- You’ve got the absolute minimum credit score away from 620

- You are making an http://cashadvancecompass.com/loans/get-a-personal-loan-with-no-credit-history/ application for a mortgage loan level of $fifty,100 or higher

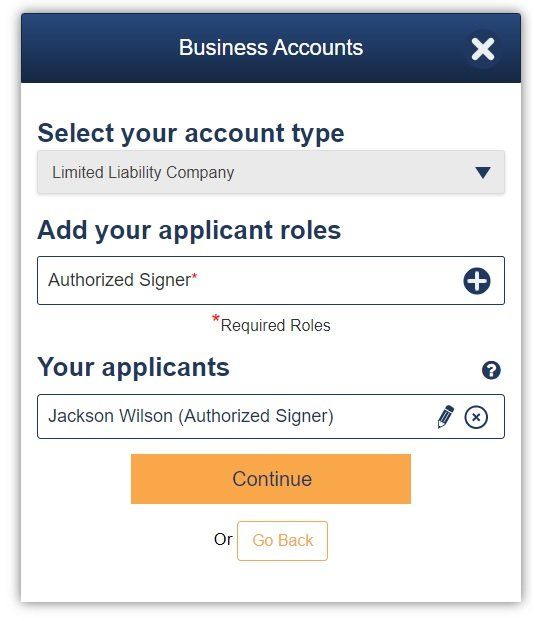

The application techniques is quite quick. After you implement on the web, you’re going to be assigned home financing representative director to walk you through it.

Verdict

If you are looking for glamorous Canadian fixed financial costs having an ensured secure age of 120 days , go to Lime. Its a secure digital banking program that provides your having prepayment privileges as much as . Additionally, you will rating suggestions compliment of dedicated agencies. It is safer to express Lime is among the top brands among the on the web mortgage lenders during the Canada that sit out.

Canadian Home loan Cost Opposed

Put another way, a home loan are that loan out-of a financial otherwise a home loan lender to assist you from inside the to acquire property. The fresh residence serves as a form of shelter for money you happen to be borrowing from the bank.

The audience is right here to help you on the mortgage-associated slang eg financial sizes, words, amortization months and much more. Discover our guide to stay static in the latest know about the top-level Canadian mortgage lenders :

The fresh new Pre-approval Techniques

There are numerous what you want knowing and create before you can get the fantasy family. Before you go selecting a home to acquire, it’s a good idea to locate pre-approved by a lender which means you score a sense of just how much you really can afford. A pre-acceptance are a standard help the loan processes, which also protects customers out-of risks.

- Expertise in the utmost home loan count you might be entitled to

- A beneficial lock ages of 60 to help you 130 weeks for the financial rates you had approved to possess

You might go for on line home loan rates analysis to help you assess the business before getting pre-recognized. When you are getting a fair idea of what is actually available to choose from, its simpler to look around to find the best revenue.

You will be spending the mortgage right until long afterwards your circulate inside the, therefore an excellent equipment to know about an informed costs manage be home financing calculator .

When you get pre-acknowledged for a home loan, your consented-through to rate would-be locked in for a period of sixty so you can 130 months , according to bank. Now your house-browse can start inside serious!

Assets costs are high, to put it mildly. All of us don’t have the whole capital to invest in all of our dream belongings. And that monthly mortgages will be the wade-to services. Prior to you can begin expenses mortgages, you will be necessary to shell out the main speed, titled a deposit .

Extent you only pay down was subtracted regarding property price, so that the big their downpayment , small your own financial amount. For individuals who lay out lower than 20% of the home rate, try to spend home loan insurance coverage.

You happen to be on the lookout for a knowledgeable Canadian home loan rates having low down fee alternatives but keep in mind that these include yet another costs mortgage insurance coverage.

Brand new and you will resale possessions insured mortgage loans are actually made available from really loan providers. For this reason, the new carrying will set you back from a minimal advance payment mortgage are large than those of the mortgage simply because they include the insurance advanced.

It is in your favor to put down as frequently money given that you could as the appeal charges for an inferior mortgage are all the way down, adding up so you can tall offers across the long term.